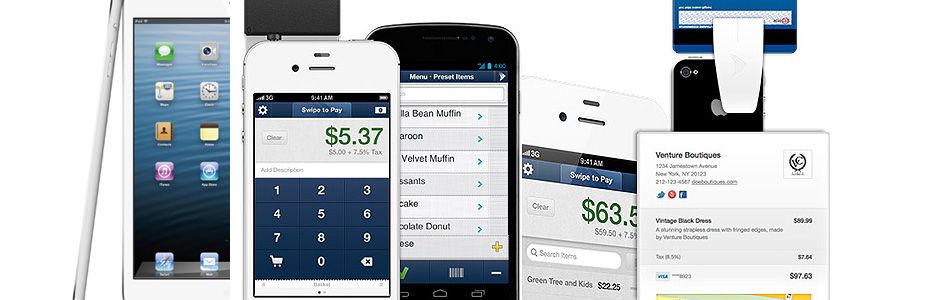

Nowadays, any company can easily process digital payments via point-of-sale devices, mobile phones, tablet devices, and online gateway interfaces, and there are many apps and programs out there that you can use for payment processing. Square has become one of most popular payment processing systems, but it isn't as reliable as you may think.

Although Square has gained popularity primarily for its compatibility with most mobile devices, there are better alternatives available today. Since the technology behind payment processing changes quickly, Square now has a number of disadvantages over its competitors.

First, Square has one of the most dismal keyed-in success percentage rates among credit card processing services. In other words, a significant number of Square’s transactions go incomplete and are ultimately rejected. Lost sales means lost revenue and frustration for your customers.

Second, Square can be quite expensive. Transaction fees tend to range between 2.75% and 3.5% with an additional 15-cent surcharge per transaction, making Square one of the most expensive payment processing systems for credit cards out there.

Third, the Square card reader is simply unreliable, explaining why it comes free with sign-up. Although the card reader easily plugs into most mobile devices, it breaks far too easily, meaning your business could be unable accept digital payments until a replacement is delivered.

Consider these insights when researching credit card payment processors for your business.